I would like to begin by highlighting that measurement technology forms the core technology of the Tokyo Seimitsu Group.

Since our founding in 1949, it was our precision measuring instruments that enabled us to expand our business opportunities— the measurement technology that we developed over this time is also utilized in our semiconductor manufacturing equipment that continues to grow in market scale.

In light of this, I am keenly aware that the Tokyo Seimitsu Group is the industry’s only manufacturer of semiconductor manufacturing equipment that also has measurement technologies.

In the past, we focused on sustaining stable earnings from two key businesses, but with semiconductor devices reaching the limits of technological advancements, we believe we can make further advances by applying our measurement technology to semiconductor manufacturing equipment. This has enabled even higher-precision inspection and processing, and our Company's core strengths are being harnessed in the world’s No. 1 manufacturing activities.

The semiconductor market continues to experience rapid advances in functionality and quantitative growth. To date, needs have been met through advances in front-end process technology for design shrinkage and larger diameter wafers. As these now approach their technological limits, the industry is seeking new solutions, such as 3D packaging, that can be realized with post-processing technology. The Tokyo Seimitsu Group offers a wide range of products for back-end process-es, and I believe we can contribute greatly to this kind of innovation.

In addition, an increasing number of countries are now pursuing national policies to strengthen semiconductor development and production. While this move presents an opportunity for the Tokyo Seimitsu Group to expand its market, it also carries the risk of creating new competition. The Tokyo Seimitsu Group is aiming to maintain its competitive advantage by investing in research and development to maintain its technological edge, as well as by developing its service structure and expanding its production capacity to improve our response to customer needs.

In the area of precision measuring instruments, which are essential for high-quality manufacturing, the Tokyo Seimitsu Group has maintained steady growth by capturing demand for measuring the dimensions and shapes of high-precision parts, especially for automobiles with internal combustion engines. Industry shifts toward energy conservation, fuel efficiency, and the unification of automobile platforms have also created new demand.

While there was a temporary lull in demand caused by the spread of COVID-19, the market for manufacturing activities does remain stable, and growing demand for NEVs toward decarbonization and greater sales in the robotics, medical care, and semiconductor industries mean these businesses are slowly expanding. Our business for test systems of batteries and other secondary cells is beginning to take hold, with business opportunities steadily increasing.

The Tokyo Seimitsu Group has set the numerical targets for fiscal 2024, the final fiscal year of the three-year mid-term business plan, to reaching ROE of 15% or higher, consolidated net sales of 170.0 billion yen, and consolidated operating profit of 37.5 billion yen.

The Group believes that the world of "Society 5.0," meaning an integration of the virtual and physical society, will continue as 5G drives advances in communication technology. We also expect the semiconductor market to grow rapidly by both monetary and quantitative measures. While the market for ICE automobiles is tending to decrease, the precision measuring instrument market is expected to grow due to the need for new types of measurements for NEVs, aircraft, and other sectors.

In the semiconductor manufacturing equipment business, we see business opportunities in the growing demand for testing systems (probing machines) as semiconductor devices and electronic components become more sophisticated and complex, and assembly equipment (dicing machines and polish grinders) as devices are comprised of more individual components. We also anticipate expansion of the machining process market related to new compound semiconductors, such as those made of silicon carbide (SiC) and gallium nitride (GaN) with a view toward going carbon neutral. To this end, we will promote development that matches the needs of our customers and expand our business by developing new products in the processing equipment category.

In precision measuring instruments, we believe that the rapid shift in direction toward carbon neutrality and the expansion of the NEVs and renewable energy markets will stimulate new demand for measurement, as well as demand for automation in manufacturing in response to the declining workforce. We also believe the semiconductor-related market presents business opportunities. To this end, we will strengthen our efforts in growth industries, as well as in the charge/discharge testing business and solutions for automation.

We are creating unique new business opportunities through the fusion of semiconductor manufacturing equipment and precision measuring instruments. By incorporating our precision measuring instruments into semiconductor manufacturing equipment, we can provide fresh new solutions and greater added value—we will also be able to expand our target markets by making our precision measuring instruments available throughout semiconductor-related industries.

With these synergies, the Company is anticipating to increase sales to around 13 billion yen in 2025.

From fiscal 2018 to 2021, the Company expanded business toward its four-year mid-term management targets (ROE of 10%, operating profit of 22 billion yen, and sales assumption of 110 billion yen). Business assumptions made at the time included advances in 5G technology and demand from China for the semiconductor manufacturing equipment business, and automobile platform innovation for the Precision measuring instrument business. Yet the sudden growth in EVs owing to moves toward decarbonization, demand from people staying at home due to the outbreak of COVID-19, and the rapid development of new working styles (WFH: Working From Home) resulted in a major growth in demand for semiconductor devices and semiconductor manufacturing equipment.

Meanwhile, significant changes had unfolded, like difficulties in sourcing the materials required for production, and these made me acutely aware that our businesses and industries related to the Company had become directly linked to the people's lives around the world and that the mission of the Tokyo Seimitsu Group was to provide the products required by cus-tomers exactly when they need them. This is why we have been expanding production capacity during the period of the current mid-term business plan—to fulfill the responsibility we have for our customers.

With global temperatures continuing to rise so quickly, the Company recognized that it should be one of the members focusing on resolving these issues, endorsed the TCFD recommendations, and incorporated into the current mid-term business plan operations for achieving decarbonization and the supply of products that contribute to decarbonization.

While the direct impact of COVID-19 and the restrictions put in place by various countries began to subside during fiscal 2022, inflation increased due to the disruption of the supply chain and other factors. Countries around the world introduced monetary tightening as part of policies aiming to curb these trends, resulting in major fluctuations in exchange rates. The war in Ukraine also triggered an increase in the cost of materials and energy, all of which led to an outlook of ongoing economic uncertainty.

Given these circumstances, we increased production capacity for the semiconductor manufacturing equipment department, to ensure that existing orders could be shipped as per the required delivery schedules. Global demand for power semiconductors required for carbon neutrality also increased, and we also responded to these changes. In the precision measuring instrument department, a resumption in capital investments that had slowed down led to signs of recovery in the market, and we moved to diversify target markets by meeting demand for charge/discharge testing systems and automation.

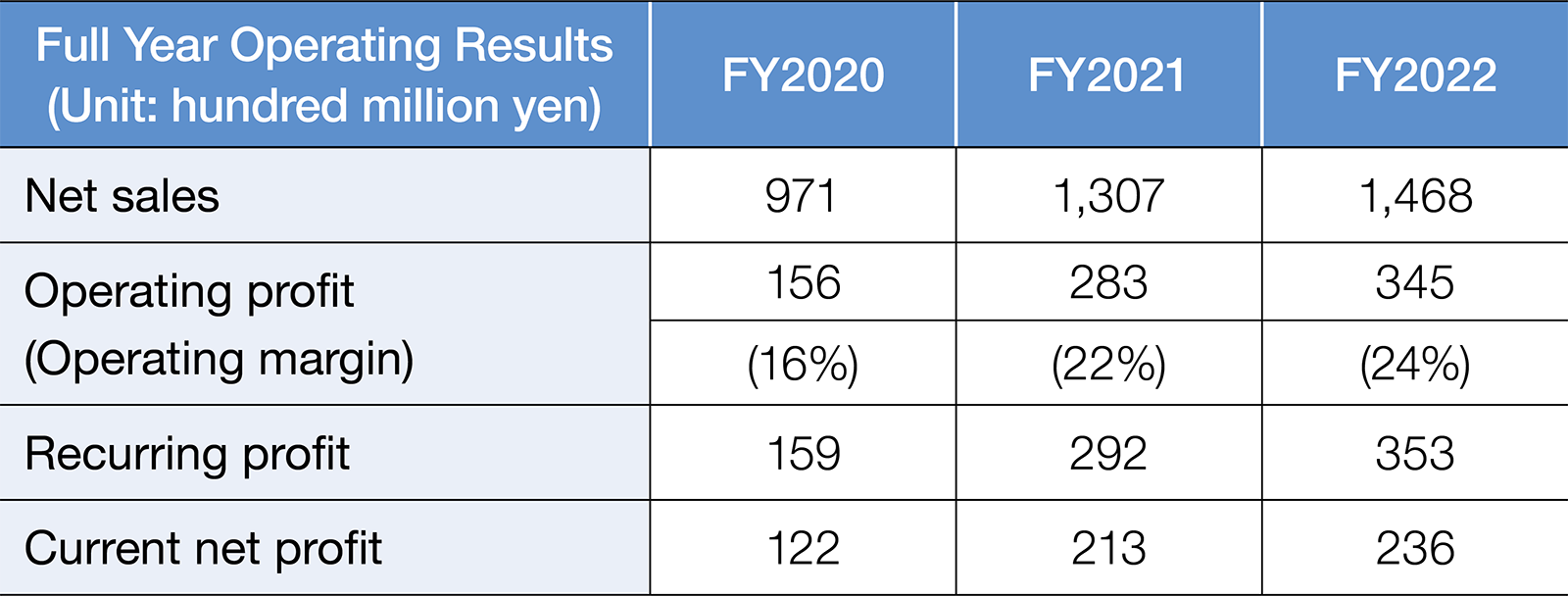

With these efforts, fiscal 2022 resulted in the third consecutive year of increased revenue and profit, and the second consecutive year of all-time highs. We also paid special bonuses in recognition of the considerable efforts made by employees toward giving form to customer feedback, despite such tough business environments.

Time flies so fast, and I turned 60 years old in 2022. At the moment, three of us hold positions with the most responsibility— Chairman and CEO Yoshida, Executive Vice President and CFO Kawamura, and myself as the COO—but this personnel structure will not continue forever. In a few years, we may have to make the decision to hand over the reins to the next President.

The most important role for me as the COO is to ensure that the strengths and strategies developed by Tokyo Seimitsu since its founding are passed on and implemented successfully, to nurture and cultivate a successor capable of sustainable growth for the Company.

I do not necessarily intend to name a successor from someone in the current management team. Instead, I hope to find skilled personnel, regardless of nationality or gender, and build up their experience before handing over the reins.

I joined Tokyo Seimitsu as a fresh graduate, where I was involved solely in the field of sales in the semiconductor manufacturing equipment department. Just like today, semiconductor devices were experiencing rapid growth, and device manufacturers and manufacturing equipment manufacturers had a mutually beneficial relationship.

The most valuable thing I learned during that time was to identify exactly what customers wanted—in other words, to listen carefully to their needs. We need to pay special attention to customer feedback at every given opportunity, to leverage their "requirements" to develop devices. This is what forms our mission. While I was working in sales, this positive chain was leveraged to deliver to customers numerous devices that became the world's first or Japan's first, and as a result, we were able to achieve what they were seeking. I personally believe that such person-to-person connections, particularly those connections leveraged for finding solutions to issues, are so important—even now in my role as the President—and I am trying to convey this level of importance to employees on a daily basis.

I am of the firm belief that "people" are key assets of Tokyo Seimitsu, and experienced engineers and the staff that assist them are the source of growth for our Group. The Company has developed a corporate culture where engineers tackle customers’ issues head-on and pursue innovation based on their wisdom and experience.

I always tell our engineers that I want them to reflect their own ideas in product development, and the Company has created a system for executing development budgets in a way that gives concrete form to their ideas. Going forward, we will continue to cherish "human resources" as our valuable assets, and work alongside our customers to be the world's No. 1 in manufacturing.