TCFD Response

Disclosure Related to Climate Change (Disclosure Based on TCFD)

In March 2022, Tokyo Seimitsu expressed its support of the recommendations of the Task Force on Climate-related Financial Disclosures. We consider rising temperatures, increasingly severe natural disasters, and other phenomena caused by climate change to pose a major risk to our business as well. On the other hand, we believe that addressing climate change will lead to increased corporate resilience and product competitiveness, as well as provide opportunities for business expansion. We will analyze the risks and opportunities that climate change poses to our business, share and work to unfold issues, and promote the disclosure of climate-related financial information based on the TCFD framework.

Governance

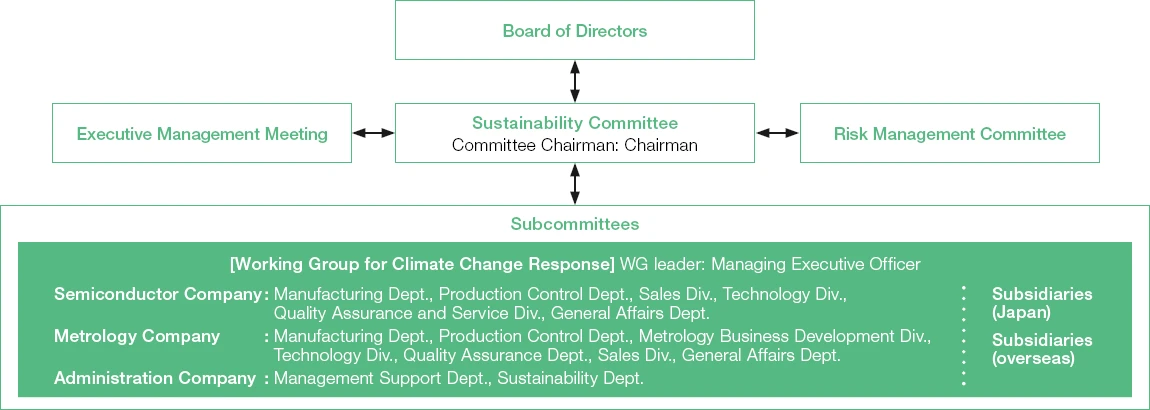

The Tokyo Seimitsu Group considers climate change a major business threat. The Sustainability Committee discusses ways to control risks and opportunities related to climate change issues and reports results of the discussions to the board of directors on a regular basis.

The Sustainability Committee is chaired by the Chairman & CEO. Its activities are reported to the semiannual Sustainability Promotion Meetings, and the report is submitted to the Board of Directors if deemed necessary by the Chairman.

The board members collect information and deepen their knowledge through various opportunities and means to grasp the ever-shifting climate change situation. The Board of Directors share the issues of risks and opportunities related to climate change, discuss goal management and problem solving, and plan to set milestones for achieving the FY2030 targets through the Working Group for Climate Change Response.

●Sustainability Committee

The Sustainability Committee is responsible for arranging, formulating, planning, and implementing sustainability activities, promoting the following activities.

Formulation of basic policy, operational framework, and goals as well as monitoring of information

Establishing and managing plans and projects

Summarization of information, reports to the Board of Directors, etc.

Matters related to various reports and information disclosure

Convening and operating a sustainability promotion council

● Working Group for Climate Change Response

The Working Group for Climate Change Response has been established as a subcommittee of the Sustainability Committee. The members of the subcommittee research and investigate activities related to climate change response and submit reports to the Committee periodically.

The Working Group is attended by the related personnel of the technology, production, sales, and management departments and has constructed a system for promoting, throughout the organization, extraction of risks and opportunities, analysis of scenarios, and investigation of countermeasures.

Risk Management

The Tokyo Seimitsu Group has established the “Risk Management Regulations” and the Risk Compliance Committee, which is headed by the president and COO, to identify and manage risks associated with business execution. Systems are in place to prevent potential risks from manifesting themselves and to prepare for crises.

The Working Group for Climate Change Response, which is a subcommittee of the Sustainability Committee, takes the lead in identifying, assessing, and investigating risks (transitional/physical) related to climate change and submits reports to the Sustainability Committee on a regular basis and whenever there is an urgent need to do so. Risks considered to affect business are relayed immediately from the committee to the board of directors for judgment.

Climate change risks have been added to the risks addressed by the Risk Management Committee. The Working Group conducts flexible discussions concerning items such as risk assessment and investigation of measures for risks that have become apparent, in order to enable response throughout the entire Group.

Strategy

We conducted a Scope 1 and Scope 2 emissions analysis of Tokyo Seimitsu’s domestic businesses.

We will continue to monitor the GHG emissions of Group companies in Japan and overseas and plan to respond accordingly. Moreover, with regard to Scope 3, we have made progress in ascertaining Category 1 *1and Category 11*2, which are expected to have high emissions. Since 2024, we have also been working to ascertain other categories.

*1: CO2 emissions from products and services purchased by the Company

*2: CO2 emissions from use of products sold by the Company

Risks and Opportunities Associated with Climate Change

Since future projections are highly uncertain and difficult to analyze, we examined GHG emissions based on multiple scenarios. International public opinion is moving toward the view that a 2°C scenario response is insufficient, so we conducted our analysis with a 1.5°C scenario in mind. However, as a 1.5°C scenario response would dilute our awareness of physical risks, we also assumed a business environment under the 4°C scenario, the level to which temperatures would rise if current economic activity were to continue.

In addition, we conducted a reassessment of environmental risks and opportunities and revised the medium- and long-term actions as follows.

Organize and address the overall picture of climate change

Exploration of new business areas

BCP enhancement, starting with our response to climate change

LCA Scope 3 (including coordination with customers and suppliers)

(Reference scenarios)

1.5°C scenario: [IEA] NZE, 1.5°C special report [IPCC] SSP1-1.9

4°C scenario: [IEA] STEPS [IPCC] SSP2-4.5, SSP3 - 7.0

| Scenario | Risks Opportunitie |

Event | Assumed Business Environment | Financial Impact |

Emergence Timing |

|

| 1.5℃ | Risks | Regulations | Carbon pricing |

|

▲▲ | Medium term |

|

Markets |

Use of EVs |

|

▲▲▲ |

Short term |

||

| Decarbonization premiums |

|

▲▲ | Medium term | |||

| Reputation | Delayed decarbonization efforts |

|

▲▲ | Medium term | ||

| Opportunities |

Markets |

Use of EvsElectrification/ digitalization |

|

▲▲▲ | Medium term | |

| Growing renewable energy markets |

|

▲ | Long term | |||

| Resource efficiency energy | Production equipment |

|

▲ | Short term | ||

|

Products services |

Low-carbon products and services |

|

▲▲ | Short term | ||

| 4℃ | Risks |

Physical |

Extreme weather events |

|

▲▲▲ | Medium term |

| Opportunities | Resilience | Disaster response |

|

▲▲ | Medium term | |

Legend

Financial Impact : ▲▲▲ Large, ▲▲ Moderate, ▲ Small Emergence Timing: Short term 2022-2024, Medium term 2025-2029, Long term 2030-

●Monitoring of GHG emissions of Group companies (Japan and overseas subsidiaries)

We have started investigation of GHG emissions of Scope 1 and Scope 2 at the manufacturing sites of Group companies.

●Initiatives toward disclosure of Scope 3

For the majority of our products, we procure the parts and materials as well as manufacture and sell the products, which are then used at the work sites of our customers.

Therefore, we believe it is important to ascertain the emissions of greenhouse gases throughout the value chain.

Since fiscal year 2024, we have launched a new Scope 3 response project and have been working to ascertain Categories 1 through 15.

Strategy for Opportunities

Opportunities in the Semiconductor Manufacturing Equipment Business Related to Climate Change

In the process of achieving carbon neutrality across all industries, we predict demand for the following:

Efficiency and energy conservation in production activities (mainly through digitalization)

Transition to decarbonized energy (mainly through electrification)

As a result of the above two measures, the scope of application of digital and communication technology will expand, and the quantity of electronic devices and electronic components used throughout society will increase rapidly. Accordingly, demand for semiconductor devices, which are components found in these products, is expected to increase continuously, and the demand for the semiconductor manufacturing equipment we provide is expected to increase dramatically in the future.

In addition, the quantity of electronic devices and components will increase with designs becoming more complex as the functionality becomes more sophisticated. As a result, there is a growing need to solve new issues in manufacturing processes. Tokyo Seimitsu develops and provides products that meet these needs. For example, we support manufacturing processes by providing high-precision processing equipment for the enhancement of SAW filters and sensor functionality.

On the other hand, the progress of digitization and electrification will lead to:

Increase in power consumption due to the expansion of data and computation (the spread of IoT devices and AI)

Increase in power loss due to the expansion of the use of electric motors

Therefore, it is necessary to promote energy conservation by semiconductors themselves in a two-fold manner. As a result, there are expectations for the spread of next-generation power semiconductors (GaN, SiC, etc.) that achieve high energy efficiency, and we are also promoting the development of related technologies and products.

Emerging Needs and the Value We Offer

As mentioned above, in order to achieve carbon neutrality, we believe that new challenges will emerge, and customer needs will also constantly change. In response to these needs, we will continue to provide new value by comprehensively responding to a wide range of products covering inspection and processing equipment.

| Expected changes in society | New challenges | Value we provide (examples) | |

| 1 | Increased production of semiconductor devices | Extended inspection times | Increased throughput of probing machines |

| Further installation of semiconductor manufacturing equipment | Stable supply of semiconductor manufacturing equipment | ||

| 2 | Increasing complexity of semiconductor device designs | Increased heat dissipation during measurement | Probing machines that support high-precision temperature control |

| Higher machining accuracy | High-precision high rigid grinders, ablation laser dicing machines | ||

| 3 | Spread of next-generation power semiconductors | Increased demand for difficult-to-cut material processing |

High-precision high rigid grinders, edge grinders, and CMPs |

Semiconductor Manufacturing Equipment Business Strategies and Goals

The Company accurately grasps business opportunities related to climate change and carries out the following initiatives in order to achieve continuous growth of the Semiconductor Manufacturing Equipment Business.

|

1. Appropriate capital investment to meet growing demand |

|

In order to meet the rapidly increasing demand for semiconductor devices, we will steadily strengthen our production system for semiconductor manufacturing equipment. The Hanno Plant began operations in July 2023, and the Company plans to complete construction of a new plant in the Nagoya area in July 2025. |

|

2. Sales activities that are thoroughly customer-oriented |

|

Since our strength lies in our thorough customer-oriented approach, our manufacturing, engineering, service, and sales teams work in unison to listen to our customers on a daily basis. Through these initiatives, we will not only quickly grasp the quantitative and qualitative needs of semiconductor manufacturing equipment but also pursue products and services that satisfy our customers, aiming to create relationships that enable us to grow together with our customers. |

|

3. Participation in industry groups and joint research |

|

Tokyo Seimitsu is a Regular Member of the Semiconductor Equipment Association of Japan (SEAJ) and leads discussions on energy and CO2 in SEAJ’s Environment Subcommittee. We also participate in the Semiconductor Equipment and Materials International (SEMI) as a Semiconductor Climate Consortium Founding Member. In addition, we will actively work on the development of next-generation technologies. As a member of Tsukuba Power Electronics Constellation (TPEC), a joint research consortium for power electronics that contributes to energy conservation in a wide range of industries and households, we are participating in R&D and human resource development. We are participating in R&D with the Center for Innovative Integrated Electronic Systems (CIES), Tohoku University, and are also taking part in the Nagaoka Power Electronics Study Group. Through these initiatives, we will also strive to develop products from a medium- to long-term and seeds perspective, and capture the technological breakthroughs and industry changes that accompany them. |

Based on the policies (1, 2, and 3) above, we aim to increase sales in the semiconductor manufacturing equipment business to 140 billion yen by fiscal 2027 (fiscal 2024 results: 113.5 billion yen).

In addition, the Tokyo Seimitsu Group is the industry’s only manufacturer of semiconductor manufacturing equipment that also has measurement technologies. By incorporating measuring equipment into semiconductor manufacturing equipment, it is possible to carry out more accurate inspection and processing, providing unique value. We expect synergies between the two businesses through this initiative to amount to sales of around 13 billion yen by 2025.

Opportunities in the Precision Measuring Instrument Business Related to Climate Change

In order to achieve carbon neutrality by 2050, it is necessary not only to decarbonize electric power sectors, which emit large amounts of greenhouse gas, but also to electrify non-electric power sectors (consumer, industrial, and transportation).

Our measurement technology plays a fundamental role in carbon neutrality measures in a wide range of fields, both in the electric power and non-electric power sectors.

1.Electric power sector

1-1. Adoption of renewable energy

➡ Bearing measurement technology for offshore wind power generation

It has been noted that a combination of multiple sources of power, including renewable energy, is needed to achieve electricity decarbonization and still provide sufficient electricity demand.

Among them, offshore wind power generation plays an important role. Offshore wind power generation is expected to be introduced in large quantities around the world, and by 2040, the amount of power generated is expected to increase by about 20 times, with an investment of about 1 trillion USD. In Japan, its growth potential and economic ripple effects are emphasized, and in the Offshore Wind Industry Vision (Phase 1), it is positioned as a trump card for making renewable energy a mainstream power source.

Bearings are components that affect the power generation efficiency of wind power generators. Those used in large wind power generators are several meters in size. With our highly accurate roundness and cylindrical shape measurement technology, we measure the shape of the bearing and whether there is any internal distortion or inclination, maximizing the effect of introducing wind power.

1-2. Expansion of the storage battery industry

➡ Charge/discharge testing system

Production of lithium-ion and other rechargeable batteries* is expected to grow dramatically due to the global spread of EVs and the stabilization of the electric power system accompanying the expansion of the introduction of renewable energy.

* While EV sales growth has recently slowed due to electric vehicle-related policies in the U.S., Europe, and China, technological advancements in next-generation automotive batteries, as well as the expansion of use cases for storage batteries, such as industrial machinery, non-automotive mobility, UPS systems for data centers, and EV charging stations, have led to global demand projections for storage batteries (for automotive and stationary use) in 2030 generally falling in the range of 2,000 to 3,500 GWh.

(Source: “Toward the Promotion of the Storage Battery Industry Strategy” and “Progress of Related Measures for the Storage Battery Industry Strategy and Major Environmental Changes Surrounding Storage Batteries,” Ministry of Economy, Trade and Industry)

Inside the factory where the charge/discharge testing system is manufactured

We develop and sell "charge/discharge testing system" that measures the performance and reliability of rechargeable batteries.

Charge/discharge tests involve repeated charging and discharging of batteries, and thus consume a large amount of electricity. However, our unique "energy sharing method," in which electricity is shared among multiple batteries under test, has realized energy conservation of up to 30% (in-house comparison). In addition to battery research and development, This product is used for a wide range of applications, including battery research and development (R&D), recycling, and performance evaluation, and contributes to reducing CO2 emissions and power costs for customers.

We are not only manufactures and sells test equipment but also provides battery evaluation services for contract testing using the equipment.

These WIN-WIN products and services contribute to climate change countermeasures by reducing customers’ CO2 emissions during testing and by accelerating R&D and dissemination of rechargeable batteries while at the same time contributing to our growth.

2. Non-electric power sectors (consumer, industrial, and transportation)

2-1. Progress of electrification and digitalization

➡ Measurement technology for semiconductor manufacturing equipment and electric vehicles

In the decarbonization of non-electricity sectors, measures for dealing with combustion equipment and facilities using fossil fuels are the main focus, with conversion to decarbonized energy through electrification (direct heating with electricity, heat pumps, electrification of vehicles, etc.) and efficiency improvements through digitalization, playing a major role toward decarbonization.

These measures will result in a rapid increase in the number of electronic devices and sensors used in society as a whole, with demand for semiconductor devices expected to grow continuously.

We provide precision measuring instruments that are indispensable for the development and production activities of semiconductor device manufacturers, electronic component manufacturers, semiconductor and electronic component manufacturing equipment manufacturers, and inspection system manufacturers. With the increase in demand for semiconductor devices mentioned above, the need for our products that support semiconductor manufacturing processes is expected to increase in the future.

In addition, since reducing CO2 emissions from automobiles is an important theme toward achieving carbon neutrality, related policies are being launched one after another in countries around the world. The Japanese government is also aiming for only electric passenger cars to be sold by 2035. In line with this, it is tasked with restructuring the automobile industry, including the development and popularization of storage batteries. The unit configuration, development, and production methods for HEVs and EVs are very different from those for conventional automobiles. In particular, the market for drive motor units, inverters, batteries, and other components unique to electric vehicles is expected to expand rapidly. We support high-precision measurement of drive system motor units and batteries by utilizing measurement technology with Coordinate measuring machines and X-ray CT systems. In the future, we will grow together with customers in the automotive industry, which is undergoing major changes, and contribute to the spread of new energy vehicles from the aspect of measurement technology.

2-2. (Industrial) Compatibility of temperature adaptation and energy conservation

➡ Measurement products that are resistant to temperature changes

While countries around the world are working to achieve carbon neutrality by 2050, the average global temperature is expected to rise between 0.5 and 1°C even if the goals set by each country are met. Furthermore, if the world does not move forward with climate change countermeasures, it is expected that the average temperature will rise by more than 4°C and the probability of extreme weather events will increase.

In response to these risks, we provide measurement products that are resistant to temperature changes in the measurement environment and contribute to the sustainable production activities of the manufacturing industry. Specifically, we provide value in the following ways.

|

Measurement environments in which it is difficult to control the temperature: |

|

Our products can handle constant temperature rises above the conventional accuracy-guaranteed ambient temperature to a certain degree. In addition, the ease of constraints on environmental temperature at the time of measurement enables flexible design of measurement and inspection processes in the factory. As a result, measurement and inspection can be performed earlier in the production process, contributing to higher productivity. |

|

Measurement environments in which it is possible to control the temperature: |

|

By expanding the range of the accuracy-guaranteed ambient temperature and being less strict with air conditioning temperature settings, our systems contribute to energy and cost savings while maintaining measurement accuracy. |

The following products enable measurement over a wide temperature range. Also, it is assumed that the automation of production processes will accelerate in the future for the purpose of avoiding work in hot environments, and demand for these products is expected to increase because they are also compatible with automation.

Coordinate measuring machines — DuraMax, XYZAX AXCEL

Surface texture and contour measuring instruments — SURFCOM NEX

In the future, we will continue to support the production bases for more industries and products by responding to customers' needs for temperature adaptation and automation with a wide range of products.

【Column:Control Function that Contributes to Energy Conservation】

Our measurement products are equipped with a function (Air Saver function) that automatically stops the supply of compressed air when the main unit is in standby mode, contributing to energy conservation without extra labor for operators.

In addition, customers who are already using our products can also add this function to their existing equipment to save energy at their existing facilities.

2-3. (Transportation) Contribution to weight reduction and efficiency

➡ Measurement technology for complex engine parts

In order to decarbonize the transportation sector, further weight reduction and efficiency of transportation equipment are required. Especially in the aircraft sector, while electrification and fuel conversion are progressing, reviewing the structure and engines of airframes continues to be an important development issue. For example, BLISK, a component that integrates the blade and rotor disc of an engine, plays an important role in reducing the weight of aircraft engines and the air resistance inside the engine.

The development and production of blisks requires high-precision metal processing and it has been a challenge to accurately measure their shapes (especially the edges of the blades). We offer XYZAX Opt-BLISK, a product that enables accurate measurement in a short amount of time by utilizing a non-contact sensor. Our highly accurate measurement technology will contribute to the efficiency and decarbonization of the transportation sector.

Strategy for Risks

Strengthening BCP and BCMS

In addition to the increasing risk of natural disasters due to climate change, there is a growing need for business continuity in emergencies from the perspective of economic security. Against this backdrop, we are working to strengthen our Business Continuity Plan (BCP) and Business Continuity Management System (BCMS).

In preparation for the intensification of disasters caused by climate change, we are implementing the following planning and management in anticipation of the suspension of operations at our plants and the damage to suppliers and subcontractors.

Assumption of damage to our own plants: We have assessed the risk of flooding at our plants (Hachioji, Tsuchiura, Hanno, Furudono) based on hazard maps and other information from local governments and confirmed that the risk of flooding is sufficiently small.

Suppliers and subcontractors: We evaluate the risk of flooding using local government hazard maps and assessment tools such as the World Resources Institute's Aqueduct Floods taking into account the magnitude of the impact on our business, including transaction value and the inability for other companies to supply the same products and services.

Strategy for Scope 3 emissions (Category 11)

As a result of calculating Scope 3 emissions (Category 1 and 11) based on Life Cycle Assessment (LCA), it was found that Category 11 emissions related to semiconductor manufacturing equipment had the greatest impact and that emission reduction efforts are highly important.

In the semiconductor manufacturing process, in addition to the power consumption of our products, energy is also consumed in the production of ultrapure water, which is necessary for clean room maintenance, temperature control, and semiconductor cleaning.

In addition, based on our LCA results, CO2 emissions associated with indirect emissions from dicing machines can be as high as or several times higher than CO2 emissions associated with electricity consumption during product use. Therefore, it is also important to reduce these emissions.

We are also working to reduce the footprint of our products to reduce the energy required for air conditioning, and to develop products that enable semiconductor cutting and processing using smaller amounts of water (ultrapure water).

Our design principles for new product development include compactness, design that achieves energy conservation throughout the product life cycle, and resource-saving design, and we evaluate LCA and set targets for indirect emissions, including CO2 emissions, during product development.

Indicators and Targets

The Tokyo Seimitsu Group aims to achieve carbon neutrality by 2050.

The Company has established CO2 (Scope 1 and Scope 2) emission reduction targets to be achieved by fiscal year 2025 and fiscal year 2030, respectively.

Since the majority of greenhouse gases (GHG) emitted by the Company is from the CO2 equivalent of electricity purchased to operate its plants, we are focusing on activities for conserving electricity.

Given that there is an increasing demand in semiconductors, the Tokyo Seimitsu Group is planning to expand production capacity in order to meet such needs, which is expected to lead to an increase in energy consumption. In fiscal year 2023, CO2 emissions increased according to the amount of electricity purchased due to the completion of the Hanno Plant and the affiliation of the Furudono Plant, which accompanied the transfer of the charge/discharge testing system business.

Going forward, we plan to promote energy conservation activities and expansion of solar power generation systems and will utilize non-fossil certificates in initiatives to reduce CO2 emissions.

CO2 Emission Reduction Targets

Target in fiscal year 2025: 35% reduction (compared to fiscal year 2018) of emissions in Scope 1*³ and Scope 2*⁴

Target in fiscal year 2030: 50% reduction (compared to fiscal year 2018) of emissions in Scope 1*³ and Scope 2*⁴

Organizations covered: Tokyo Seimitsu Co., Ltd. (non-consolidated basis)

*3:Direct GHG emissions by the Company (emissions from fuel combustion, on-site power generation, and industrial processes)

*4:Indirect emissions resulting from the use of electricity and heat supplied by other companies (e.g. emissions associated with electricity purchased from electric power companies)

Result CO2 Emissions and Targets for FY2025

| Previous five-year plan | New five-year plan* | ||||||||

| Unit | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | FY2024 |

FY2025 (plan) |

FY2030 (plan) |

|

| Emissions | t-CO2 | 11,982 | 9,524 | 8,191 | 8,257 | 11,598 | 12,733 | 8,003 | 6,156 |

| (Compared with FY 2018) | % | Down 2.68 | Down 22.64 | Down 33.47 | Down 32.94 | Down 5.80 | Up 3.42 | Down 35.00 | Down 50.00 |

| Electric power used | MWh | 25,448 | 28,843 | 29,835 | 29,546 | 37,432 | 43,316 | - | - |

|

CO₂ emissions |

t-CO₂/ million yen |

0.191 | 0.129 | 0.080 | 0.074 | 0.111 | 0.103 | - | - |

Organizations covered: Tokyo Seimitsu Co., Ltd. (non-consolidated basis)

The results for fiscal year 2023 include data from the Hanno Plant starting in July when the construction was completed and from the Furudono Plant following the transfer of business in October.

*In 2021, we revised our reduction target and extended the period by one year.

Environment・Society・Governance